Banks strike back at private credit in ‘aggressive’ push to win deals

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Buyout firms are shaving tens of millions of dollars off interest costs by refinancing debts racked up in private credit markets with publicly traded bonds and loans, delivering a windfall for the Wall Street banks that arrange them.

Roughly $10bn of so-called private credit loans have been refinanced in public markets, as borrowers pay down burdensome loans in favour of a cheaper alternative, according to data from Bank of America.

Private equity firms that buy out companies are taking advantage of a recovery in global corporate bond and loan markets, after the Federal Reserve signalled that inflation had been sufficiently tamed for it to begin cutting interest rates.

That shift has opened the door for investment banks to pitch hard for business that they lost to private lenders after rates dramatically rose in 2022, with the banks hoping for a revival of lucrative fees.

“Pressure is coming from sponsors for the coupons to be cut and this is just a race to the bottom between the banks and the direct lenders,” said Neha Khoda, a strategist at Bank of America.

The list of borrowers shifting from private to public debt markets includes Veritas-backed energy consultancy Wood Mackenzie and UK insurance broker Ardonagh, according to people briefed on the matter. Ardonagh is owned by Madison Dearborn and HPS Investment Partners.

Other firms, including Blackstone and Hg, have sought cut-rate loans for new deals, with banks and the direct lenders of the private credit industry often being played against each other as private equity firms look to whittle down interest costs.

It culminated last week with the sale of a $5bn loan that backed KKR’s purchase of a stake in a healthcare technology company known as Cotiviti. An aborted investment last year in Cotiviti was initially to be funded by direct lenders, as ructions in public markets pushed banks to the sidelines.

But banks led by JPMorgan Chase lobbied hard to underwrite a financing over the past four months as a new deal moved closer to the finish line. The package they clinched on Thursday included a $4.25bn loan that pays an interest rate just 3.25 percentage points above the Sofr floating rate benchmark, a level far below the threshold considered last year by private lenders. The company also raised a $725mn fixed-rate loan with a coupon of 7.63 per cent.

The changing market conditions offer an opportunity to banks, which were saddled with billions of dollars of losses on the deals they agreed to finance in 2022.

Scorching inflation and rapidly rising interest rates made it difficult for big lenders to shift loans off their own balance sheets and into the hands of other investors.

That included loans associated with some marquee buyouts including Elliott Management’s takeover of technology business Citrix, Elon Musk’s purchase of social media company Twitter and Apollo’s acquisition of telecommunications group Brightspeed. The losses limited lenders’ interest in extending new loans, and when they did the terms were often too expensive for private equity firms to turn to.

Private credit funds stepped into the gap, writing multibillion-dollar loans to companies including Norwegian online classifieds company Adevinta and software maker New Relic, and providing money at a time when cash was harder to come by.

“Direct lenders made significant market share gains on the banks because the banks were undergoing periods of stress,” said Kipp deVeer, head of Ares’ credit business. “Those market share gains are lasting but it ebbs and flows.”

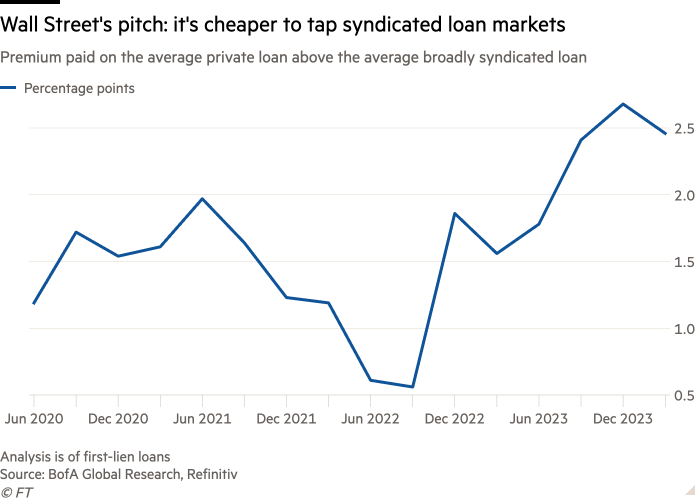

The gulf between the two worlds had not been this wide in at least a decade, said Khoda. By her calculations, direct lenders were charging roughly 2.5 percentage points more than banks. A year ago, that figure was a full percentage point lower.

“As we’ve turned the year you see banks being more aggressive,” said Chris Bonner, who heads leveraged finance capital markets for Goldman Sachs. “You have seen more stability in the ecosystem, [with investors] feeling rates are finally coming down . . . As an underwriter you’re more comfortable putting on risk positions.”

This shift has heaped pressure on private credit lenders, which are either rapidly reducing the costs they charge borrowers — in some cases waiving fees to keep deals in their hands — or losing those deals to traditional syndicated loan markets.

The issue may present less of a challenge for the colossal money managers that straddle both worlds, given many of the giants in the private credit industry — including Ares, Blackstone and KKR — are also massive players in public debt markets. But the direct lending funds they manage may begin to post lower returns, investors said.

In a board meeting last month, an executive at the $105bn Ohio Public Employees Retirement System said the generous return on private credit may shrink as competition intensifies. “It wouldn’t surprise me in the coming years if we do see some compression in terms of the spread we are able to earn,” she said.

Pressure on yields has also been exacerbated by a dearth of big mergers and acquisitions since the Fed began raising rates.

“There have been fewer LBOs and therefore less new loan volume,” said Michael Patterson, a governing partner at asset manager HPS Investment Partners.

“Managers have not invested as much capital as they expected and . . . want to make sure they participate in the next opportunity. And they’re willing to be aggressive to make sure they do.”

Fees underwriting these risky deals in the US have risen 35 per cent year to date to $1.8bn, according to data from LSEG, and are up 10 per cent globally.

Nonetheless, banks have quite a bit of room to make up, given they earned about $11bn on their US leveraged finance businesses in both 2023 and 2022. That was down a third from 2021 levels, when it surged above $16bn.

Risks still lurk, and bankers say they have not forgotten how quickly things could unravel like they did in 2022. But they are hopeful that now is their time to strike, particularly in an election year when markets may be more volatile.

Private credit lenders add that they are not going anywhere. Even as fundraising slows from its white-hot pace, large managers are still pulling in billions of dollars a quarter to make new loans.

“In order for you to have a functioning capital markets ecosystem you want the banks involved,” said Milwood Hobbs Jr, a managing director at Oaktree, the investment manager. “Everyone is losing sight of the fact that this market is too big for just private credit or banks.”

Additional reporting by Sun Yu

Comments